Brent crude rose from $69 to $74 highlighting the global energy significance of the Strait of Hormuz amid the Iran-Israel tensions, the U.S. Energy Information Administration (EIA) pointed out.

According to the U.S. Energy Information Administration (EIA), the Strait of Hormuz is deep enough and wide enough to handle the world’s largest crude oil tankers, and it is one of the world’s most important oil chokepoints. Large volumes of oil flow through the strait and very few alternative options exist to move oil out of the strait if it is closed.

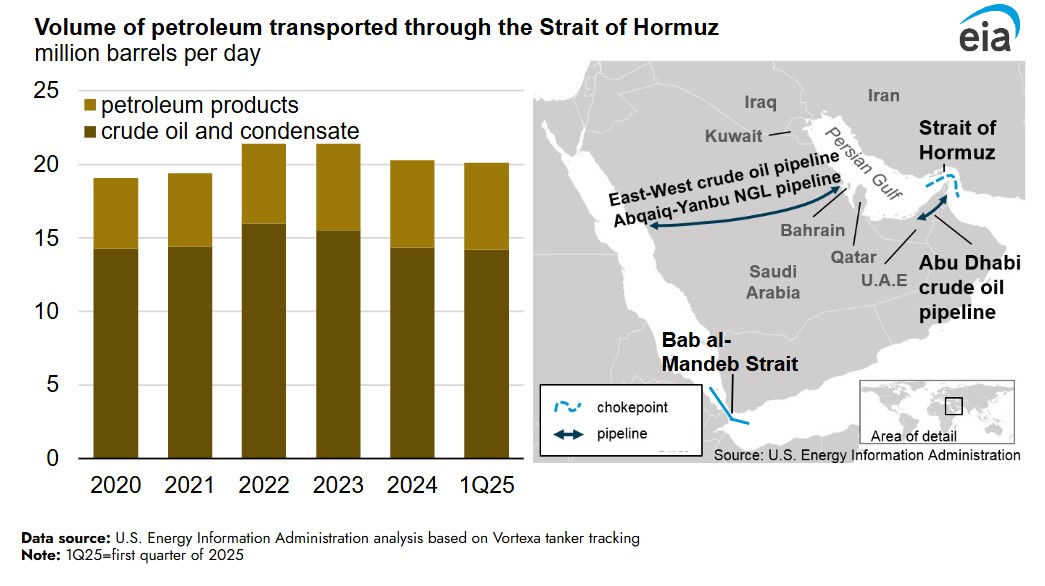

In 2024, oil flow through the strait averaged 20 million barrels per day (b/d), or the equivalent of about 20% of global petroleum liquids consumption. In the first quarter of 2025, total oil flows through the Strait of Hormuz remained relatively flat compared with 2024.

Although maritime traffic through the Strait of Hormuz has not been blocked following recent tensions in the region, the price of Brent crude oil increased from $69 per barrel (b) on June 12 to $74/b on June 13. This piece highlights the importance of the strait to global oil supplies.

Although maritime traffic through the Strait of Hormuz has not been blocked following recent tensions in the region, the price of Brent crude oil increased from $69 per barrel (b) on June 12 to $74/b on June 13. This piece highlights the importance of the strait to global oil supplies.

Furthermore, EIA highlights that the inability of oil to transit a major chokepoint, even temporarily, can create substantial supply delays and raise shipping costs, potentially increasing world energy prices. Most volumes that transit the strait have no alternative means of exiting the region, although there are some pipeline alternatives that can avoid the Strait of Hormuz.

Between 2022 and 2024, crude oil and condensate volumes transiting the Strait of Hormuz declined by 1.6 million barrels per day (b/d), a drop only partially offset by a 0.5 million b/d increase in petroleum product shipments. This reduction largely reflects OPEC+ decisions to voluntarily cut crude production, beginning in November 2022, which led to decreased exports from Saudi Arabia, Kuwait, and the United Arab Emirates (UAE).

Additional pressure came in 2024 from disruptions around the Bab al-Mandeb Strait, linking the Arabian Sea to the Red Sea, prompting Saudi Aramco to divert seaborne crude away from the Strait of Hormuz and instead transport it via the East-West pipeline to Red Sea ports. Meanwhile, expanded refining capacity within the Persian Gulf states raised regional demand for crude, further redirecting some flows to local markets.

Despite these shifts, flows through the Strait of Hormuz in 2024 and the first quarter of 2025 still accounted for over one-quarter of global seaborne oil trade and about one-fifth of total global oil and petroleum product consumption. The strait also remained a critical route for liquefied natural gas, with around one-fifth of global LNG trade, primarily from Qatar, transiting through it in 2024.